In high school, many students believe that the responsibilities of adulthood are worlds away. Paying bills, starting a career, and maintaining financial stability are irrelevant in their lives today. This mindset is typical yet flawed. Preparing for a successful career and lifestyle is always important to think about. This is especially important for high school students who are on the cusp of becoming adults themselves.

To prepare for the future, high school students must be aware of how they can start growing their finances. One of the best ways to do this is to begin investing.

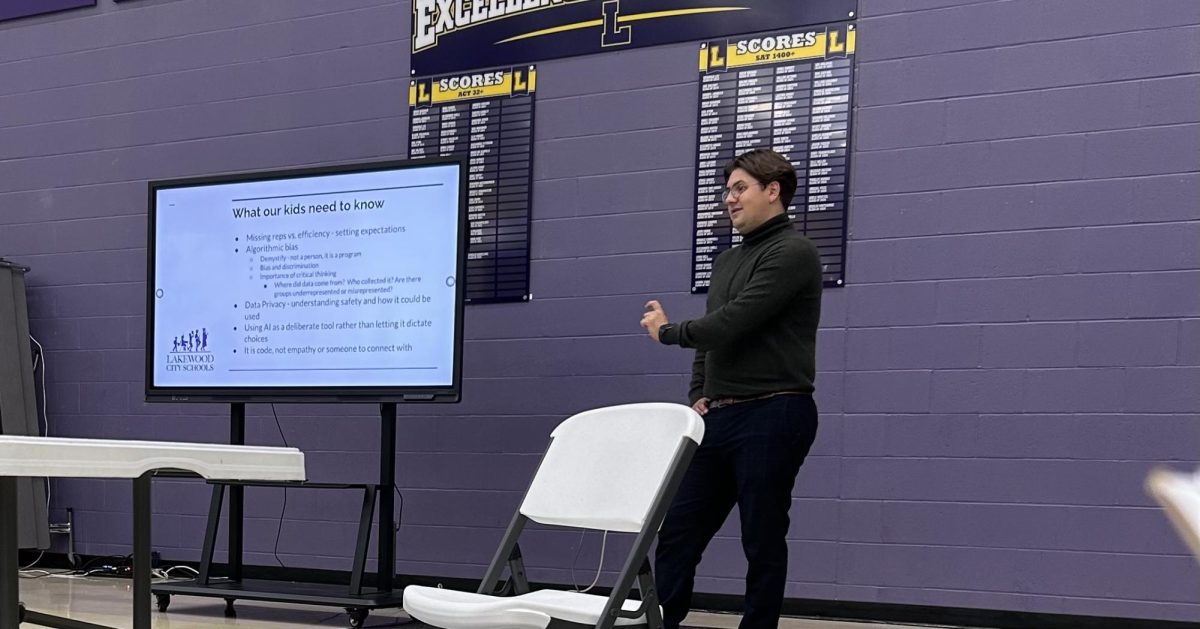

Investing sounds intimidating, but with the proper steps, it can be a simple process that grows your money, unlike any other financial system. Michael Bentley, the vice president of investments at Johnson | Bentley Wealth Partners of Raymond James, describes why investing is so powerful.

“The longer you’re in and investing, the more money you ultimately end up with,” Bentley said. “So your money realistically, especially at a younger age, should probably double every seven to ten years.”

Investing allows you to grow your money over time. This is why starting as early as possible can be highly beneficial. Joe Zombek, Lakewood’s financial literacy teacher, discusses this process in more detail.

“The earlier you start investing, the better chance you have of making more money, because investments build on themselves,” Zombek said. “It’s called compounding. So, even if I don’t put in very much money in, it’s going to keep building upon itself.”

In most cases, preparing for the future by investing early on will lead to a successful career and lifestyle. This reminder can be helpful to all high school students who want to expand their income in years to come.

In order to begin investing at a young age, there are some economic concepts that they should understand before jumping into the market. Risk is the main idea young investors should be aware of.

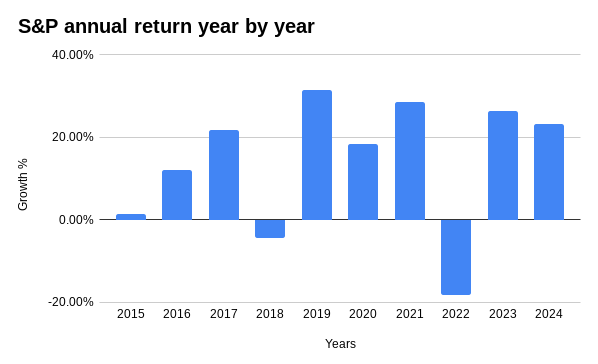

When you invest in stocks, you allow another corporation to borrow your money in hopes that your assets will grow. The problem is that you can also lose money when you invest in a declining establishment.

“The faster it goes up, the faster it can fall,” Bentley said. “It can become a roller coaster and just like when you stretch a rubber band, it eventually snaps back to where it was.”

Investments are never certain, which is why the process can be risky.

“There is no such thing as a guaranteed investment,” Zombek said. “Every investment comes with some level of risk. And one of the things any investor has to do, whether they’re young or old, is determine how much risk is acceptable to them.”

Although investing is risky, it’s also important to understand that if you take the right steps, it’s not quite as uncertain. Student Bipraviyani Thapa Chhetri explains how you can lessen risk and keep your money safe.

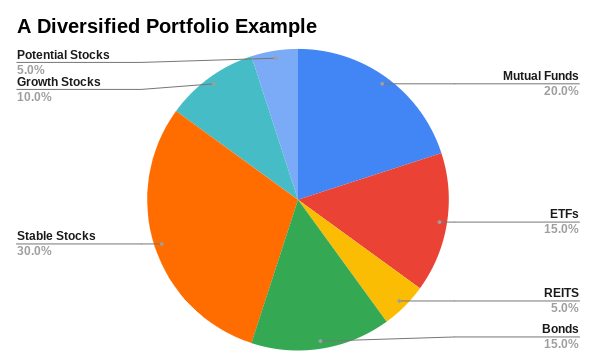

“It can be stressful to invest because the market does go up and down. However, if you diversify your stocks, if you invest in multiple stocks, then you don’t ever really lose money. You might not gain it all the time, but your money is eventually going to grow” said Chhetri.

The stock market is risky and stressful when you invest blindly. By spreading out your money and staying informed about your stocks, you can take the stress off of investing. However, the best way to manage your stocks is to not. Hiring or talking to a financial advisor can boost your money by a wide margin.

“Young investors can safely navigate markets by working with a professional,” Bentley said. “That helps you have a third party that will take the emotion out, and make sure that you don’t make bad decisions. There’s a reason why the average investor, an individual investor, only makes 2% a year…working with a professional adds anywhere between three and a half and four and a half percent per year to your returns.”

Working with a professional to create a financial plan can help you grow your investments and learn more about different investment options. Whether you use professional help or try to invest on your own, starting as early as possible is beneficial. Investing can help double your income in 10 years or less while helping you ensure a prosperous future.