The stock market is where companies and individuals can buy or sell shares from corporations worldwide. Each share gives an investor partial ownership of the company, and depending on the business’s success, investors may gain or lose money. The stock market depends on the success or failure of its companies, and many corporations rely on the investments made by shareholders. When the stock market crashes, the economy will reap the consequences. Our capitalist economy rests on the fate of its businesses and the exchange of money in places like the stock market.

In recent weeks, the stock market has undergone some major changes. Many markets around the world are seeing a decline in their investment value and overall growth. Mr. Zombek, Lakewood’s financial literacy teacher, explains the causes of this crash in more detail.

“The biggest thing that is affecting the stock market is tariffs, for two reasons,” Zombek said. “First of all, tariffs historically would make the value of some companies people invest in go down. It’s going to be harder to buy and sell things. And secondly, the uncertainty that businesses don’t have a plan for how to deal with changes right now, but they eventually will…So the more people want to sell stocks, the more value those stocks are going to lose. The more people want to buy them, the more value they gain.”

As we see in the simple concept of supply and demand, consumers are the driving force behind price and value. Investors dictate values in the stock market, and the more people who want to buy a certain stock, the higher the price. In the unstable, uncertain market we are seeing today, investors lack the confidence to continue holding on to their shares and, in turn, are losing value. Many investors fear losing their money and sell their stocks in defense. This is a downward spiral; as more investors sell their stocks, more and more lose value, and the market dips.

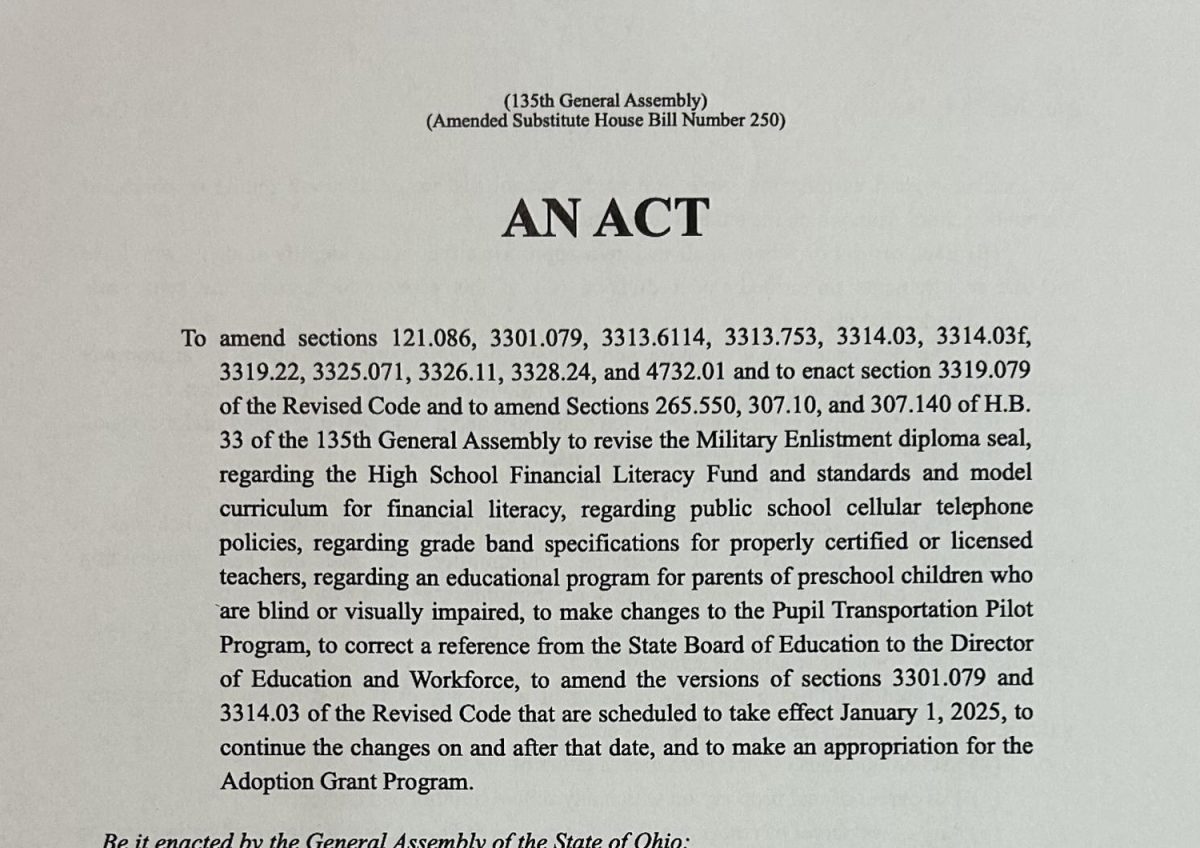

Due to political and economic changes in our country and around the world, the stock market is seeing this recession process firsthand. Tariffs and conflict are huge contributors to this decline and prove that the stock market is connected to more than what meets the eye. In early April, President Trump implemented disastrous tariffs on imports from countries like China, Canada, and Mexico. Some of these tariffs reached as high as 54%, a significant hit on previous prices. These aggressive changes led to a massive decline in markets such as the S&P 500 and NASDAQ. Dips in the economy as well as the stock market have raised the probability rate of a recession to 60%. Economists predict this recession based on extreme trade wars that threaten our economy and stock markets. The fate of our country rests on the fate of our economy.

Mr. Branco, a math teacher at Garfield Middle School, explains how the decline of the market may have deeper effects than expected.

“Even if you don’t invest in the stock market yourself, it still affects you,” Branco said. “When the market drops, businesses sometimes slow down hiring or spending, which can lead to fewer jobs or slower growth. People’s retirement accounts, like pensions or 403(b)s, can lose value too, even if they aren’t actively trading stocks. Plus, when people see bad news about the market, they might spend less money, which can hurt stores, restaurants, and even schools in the long run. So even if you’re not directly involved, the ripple effects can reach almost everyone.”

The stock market will impact everyone whether you invest or not. But this shouldn’t scare investors planning to stay in the market for a long time. The stock market has seen inconsistencies, but eventually, the pendulum usually swings back and corrects itself. When you see lows and highs, trusting your money in such an unstable environment can be hard. Yet, there is one trend we can see from the very beginning of its creation: the market has always risen more than it has fallen. Even though market dips can be concerning, it’s important to leave your money in the market and let it gain back its value.

“Invest for the long term,” Zombek said. “You know, the drop in stocks last week was certainly not fun to look at. But historically, after the stock market drops, after a period of time, it’s going to go back up…Just be patient. Don’t pay attention to the hype. History tells us that the stock market will correct because at some point or another, businesses are going to figure out how to make money. It’s just what they do.”

The stock market has always corrected itself. Because of this, it is important to keep your money in your investments and worry less about the decline and more about long-term growth. Marin Nash, a young investor at Lakewood High School, explains her choice to keep her investments.

“It’s better to just ride out the decline,” Nash said. “At first, I really wanted to sell mine when the market was low but [my advisor] was very adamant that I shouldn’t. I think in the long run it is better because more people are gonna invest when it’s lower so then your stock value is raised.”

While previously invested money will lose value during a decline, taking advantage of a low market can help you grow your money. At a time when the market is lower, shares are much cheaper and, therefore, have a higher potential for growth.

A decline in the market is not all bad but should be taken seriously. The stock market can be used to measure the strength and success of our economy, as its fate depends on the prosperity of our people. The stock market is interconnected with more than what meets the eye, and its recent levels could be a reminder of our country’s economic vulnerability.